On March 29th, British Prime Minister Theresa May triggered Article 50 to start the process for the UK to leave the European Union. Then, less than a month later – April 18th – the PM called for a snap general election.

We at Net Affinity have being watching developments closely, along with the rest of travel industry and, indeed, everyone else. Brexit will certainly affect tourism – but what specific impact will this have on the hotel landscape?

Early signs from June 2016, when the initial vote for Brexit took place, showed few changes to demand in the market. However, with a snap election announced the process of leaving the EU officially commenced, have things changed?

The snap election, with polls as they currently stand, seems likely to reinforce the hard Brexit that Theresa May and other members of the UK conservative party are pushing for.

Here’s one change we can currently analyse with certainty: the drop in the pound versus the euro now makes Ireland an expensive destination in the eyes of the United Kingdom and Northern Irish traveller.

The drop in the value of the pound that Brexit caused is likely affecting tourism to all countries. However, since Ireland is so close to the UK and there’s such heavy tourism traffic between the two countries, it’s a particularly interesting case. We’ve examined it in depth below.

Here’s what we know, and here’s what hotels can do to maintain and grow direct bookings in the wake of Brexit.

The Brexit Effect: What We Know

In March 2017, the CSO (Central Statistics Office for Ireland) released figures stating that UK visitors to Ireland were down by 5.9% for Dec ‘16 to Feb ’17, compared to the same time last year.

The same report shows that, over the same period, Ireland saw a 1% increase in European visitors and 38.2% growth in North American visitors. Other long haul destinations were up by 20%.

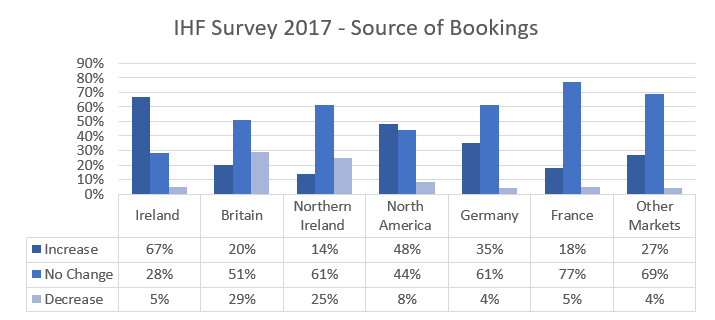

A recent survey by the Irish Hotels Federation shows that 4 in 10 Irish hotels are seeing a drop in advance bookings from Britain, while just over a quarter have said that bookings from Northern Ireland for the remainder of the year are down compared to 2016.

Brexit and the accompanying drop in the value of the pound is almost certainly the cause behind this drop in UK and Northern Irish visitors.

Which areas in Ireland are most strongly affected by this drop?

The Irish Hotels Federation have stressed that the border counties are likely to be significantly more affected by Brexit than those further away. Border counties lie on the border between the Republic of Ireland and Northern Ireland, and welcome over 57% of all visitors coming from Great Britain & Northern Ireland.

Although hoteliers are reporting a drop in Northern Irish and UK business, they’ve still had a strong start to 2017. Almost 3 in 4 Irish hotels show business levels are up compared to this time last year, according to the IHF.

The increase is coming from domestic, US and continental markets:

Data Source

Brexit’s Impact on Bookings and Arrivals

At Net Affinity, we have been carefully watching our hotels in Ireland to see the impact of Brexit. Here are the key results from our study:

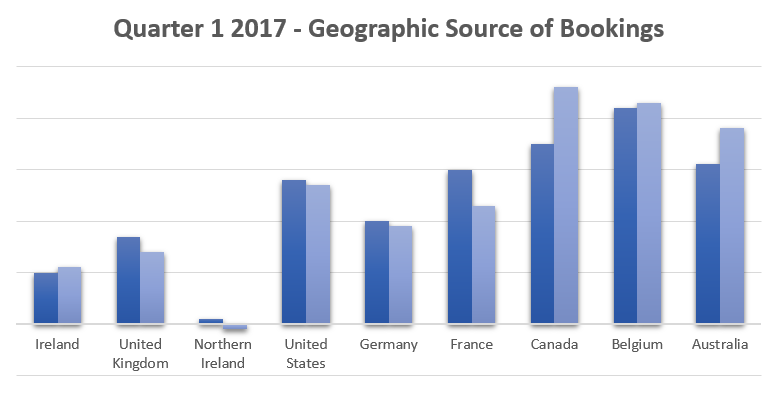

When analysing bookings, we are looking at bookings made for the 1st quarter of 2017 versus the same time in 2016.

These bookings were all made after the vote for Brexit was approved, and can be for stay dates in the 1st quarter or anytime into the future.

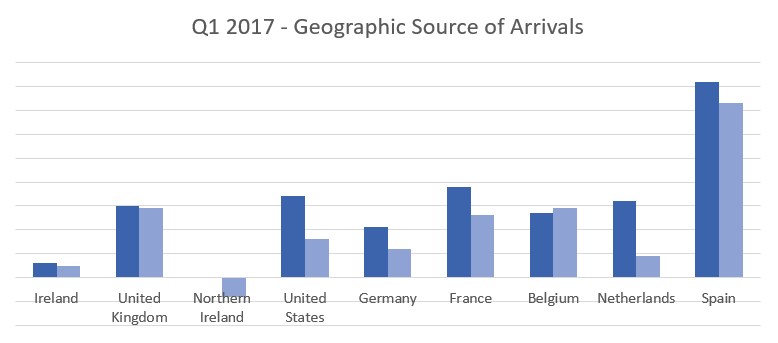

Arrivals, however, take into account bookings that were made long in advance of Brexit and therefore show very different results. Keep that in mind as you go through the analysis below.

All the figures below compare Q1 2017 versus Q1 2016.

Bookings Breakdown & Growth

In Quarter 1 of 2017, hotels in Ireland saw the UK & Northern Ireland markets grow 18% in bookings and 13% in revenue. They now see this market account for 30% of hotel Bookings and 30% of revenue overall.

The largest share of this growth comes from the UK* at 17% of growth in bookings.

The USA saw the largest growth in Q1 of 2017, although it’s a less significant market for Irish hotels overall.

Other markets which saw positive growth were Germany, France, Canada, Belgium and Australia.

* Bookings that are tagged as coming from the UK may in fact be from Northern Ireland, depending on what customers enter in address fields. Therefore, we often look at Northern Ireland & the UK together.

Arrivals Breakdown & Growth

All the key markets have seen an increase in arrivals and revenue versus the same time in 2016. Many of these bookings were made long before the Brexit vote happened.

Northern Ireland and UK markets make up 33% of Arrivals and 35% of Revenue. this shows and increase of 30% for arrivals and 21% for revenue.

The largest share of this growth comes from the UK*, at 30% of growth in arrivals.

The USA market, while again smaller for many Irish hotels, ha seen the largest growth over the same period.

* Again, it’s likely that some of these bookings are in fact from Northern Ireland..

Border County Hotels

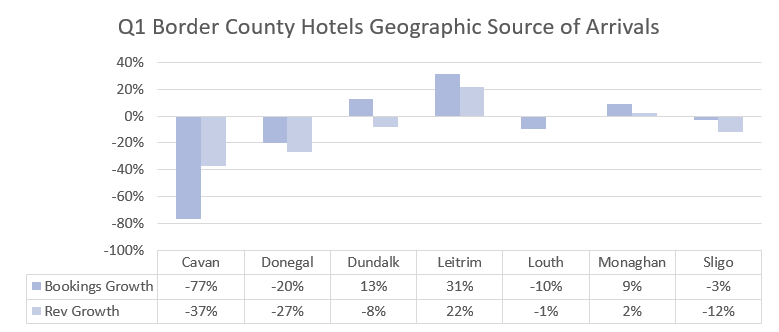

Counties included: Cavan, Donegal, Dundalk, Leitrim, Louth, Monaghan, Sligo

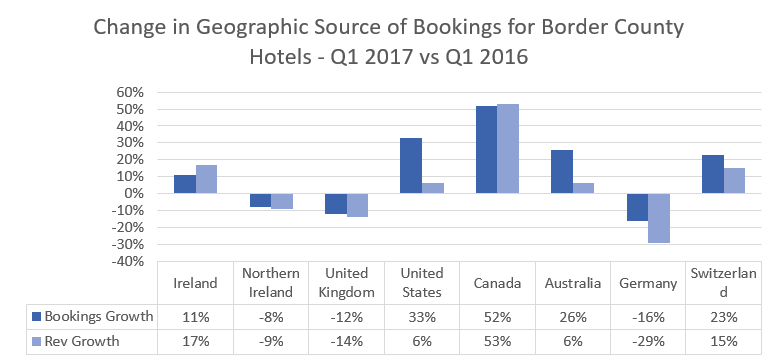

When the booking and revenue data for Q1 2016 vs Q1 2017 is broken down to focus on the border counties, the story gets a bit more interesting.

Bookings for Border Counties:

Bookings from Ireland now account for 43% of bookings for border counties, compared to 39% in same quarter in 2016.

Northern Ireland and UK bookings have dropped for the border counties significantly in the first quarter of 2017: a 20% drop for bookings and 23% drop in revenue.

However, they still account for a big chunk of bookings for these hotels.

UK and Northern Ireland bookings collectively made up 49% of bookings and 51% of revenue for border hotels.

More optimistically, bookings from the US and Canada saw large growth in the first quarter of 2017.

Whilst nationally hotels have seen an increase in arrivals for the first quarter of 2017, the border counties saw a decline of 8% in arrivals from the UK & Northern Ireland and a 9% decline in revenue.

Crowe Horwath, a leading accountancy firm in Ireland, took a recent survey in September 2016 on the impact of Brexit.

Their survey showed that 57% of hoteliers said that Brexit had not impacted their business since it was announced. However, 82% of respondents in border counties felt it had directly impacted on their business.

The same survey also looked ahead for 12-15 months at how hoteliers felt it would affect future demand levels. 64% of respondents in Ireland anticipate that demand levels will remain steady or increase in next twelve months.

That said, the responses in northern region were more negative: 75% expect a decline in demand in the next 12-15 months.

Factor Brexit Into Your Book Direct Strategy

The effect of Brexit, for now, are most strongly felt on the immediate borders of the United Kingdom. However, we are only now beginning negotiations. Hotels should shore up their resources and strengthen their presence in other markets to prepare for all possible outcomes.

Hotels must bring Brexit into their book direct strategy. Here are Net Affinity’s top tips for maintaining and growing direct bookings in the wake of Brexit:

Use Google Analytics and your Booking Engine to Gather Intelligence

We all know the importance of retaining customers, but today’s marketplace is highly unpredictable.

Given that many hotels are very reliant on the UK and Northern Ireland as a market, hotels need to attract new customers. Hotels that attract a large volume of UK and Northern Ireland business are going to be the first to see the impact of Brexit, so ensure you have other markets that you can focus on in low periods.

Make this a part of your book direct messaging. Are you targeting guests in new markets? Is your message crafted with those users in mind? UK, Northern Ireland and the Republic of Ireland share many cultural similarities, so the messaging for all three can be quite similar. When you’re casting your net wider, though, you must make sure you’re still communicating clearly.

To ensure that, start with the data.

Whilst global data is good and helpful and always gives an indication on how the market is performing, your own hotel’s data cannot be underestimated.

Consult your Google Analytics account to dive into user behaviour. Use this information to your advantage. Track your demographics carefully and look at individual markets to see the behaviour of these markets. When you have a good grasp on your ‘ideal guest’ in these markets, you’ll be able to create special offers specifically for your target markets.

Consulting an expert can be extremely helpful, if you don’t have the in-house time or expertise to dedicate – consider talking to a digital marketing agency, if you aren’t already working with one.

Remember that your booking engine is full of useful data, and using it can give you a major competitive advantage.

We understand it can be a little intimidating to know where to start. Net Affinity recommend you begin by analysing the Geographical Breakdown of your bookings. This gives you a better understanding of your key markets.

For example, use your booking engine to inform you of the rateplans booked, length of stay, ABV and more for different markets. You’ll be able to target these markets with the right offers at the right time.

Remember: data should be used to your advantage. By watching and understanding consumer behaviour, you can plan ahead!

Know Where Your OTA Bookings are Coming From

Look at who’s booking your hotel on third party channels at a higher cost – you might find new markets as future targets for your hotel.

Interestingly, a lot of hotels believe that OTA’s bring them “new” overseas business, but this may not be the case. Often, the OTA’s claim incremental business that with a bit of work you could persuade to book on your own website.

By knowing what business your OTA’s give you, you can build a book direct strategy to get these customers booking on your brand site instead.

Ensure Your Website Can Sell to Various Markets

Your website is your hotel’s virtual welcome mat, or a ‘shop window’, and it needs to appeal to a lot of different markets. The Republic of Ireland, Northern Ireland and UK markets are very similar. If you’re investing in new markets, does your website sell to them?

For example, do you have a translation feature on your website? Have you got currency convertor features on your site? Are you selling your property correctly, and in the correct language?

These tools and tactics help various markets convert directly, rather than leaving your site and going to an OTA.

You need to make a great first impression. Net Affinity global stats show that many transactions happen the first time or on the first day a user visits a website – therefore, it is important to put your best foot forward.

Ensure your offering is clear. Clearly explain the differences between your different room types. You ned to inform the customer why they should pay more – is the room bigger? Does it have additional features? Make your selling points clear.

Follow one type of price display method:

Use the same pricing method across your site. This is a recommendation we would make for any hotel looking to pursue a successful book direct strategy.

When some pricing is per person sharing, or total stay, or per room per night, it makes it difficult to compare offers and decide which is best value.

We have found that hotels that use a total price display method have seen a 20% increase in conversion over other pricing methods, so make sure you’ve got a consistent, ideally total pricing display in place. OTA’s, who spend a great deal of time and money on researching what makes consumers book, always use a single, usually total price display on their sites.

Go through your website and booking process as a guest would:

Take the time to read the descriptions and look at the price display. Is it clear? Consider getting a person less familiar with your hotel website to do a walkthrough as well.

If anything causes you to think or hesitate, you can be certain potential guests aredoing more than just thinking – and chances are they have moved onto a third party or a competitor site.

Invest in Paid Online Activity

You must protect your brand online. In a space where paid activity accounts for nearly all “above the fold” search results, hotels today need to spend to appear. This is one of the cornerstones of a book direct strategy.

If you’re not bidding on your brand terms, you can be certain that OTA’s are, and they’re scooping up clicks and bookings because of it.

It is important to ensure that your marketing spend accounts for the natural peaks and lows of different markets. Not all markets travel at the same rate each month or season, and your marketing campaigns should reflect this.

There are a vast array of options for paid activity, from Google Adwords to Bing to Metasearch channels to Social. To know which combination is best for your hotel, you’ll almost certainly need to consult a digital agency or risk doing a great deal of trial and error.

Whichever platform you are on, you need to ensure you are getting the best possible return on your investment.

Ask your marketing specialists to closely monitor your various location campaigns, and reinvest if you are not seeing a good performance from certain markets.

For example, our digital marketing specialists at Net Affinity are constantly tweaking AdWords campaigns to ensure clients are getting the highest possible return on investment. It’s not a case of one size fits all.

Content is King

The best way to attract new customers to your hotel website is through content. Remember, your website is your digital welcome mat.

Blogs and news feeds are always helpful. They help your guests feel in touch with you, give you a perfect place to showcase different elements of your hotel, and give your site new content for search engines to crawl.

When you have fresh, relevant content, you generally rank higher on search engine results, getting you more organic traffic and direct bookings.

Most importantly, in a market that is ever changing, be ready and be flexible.

Conclusion

The effects of Brexit are starting to show in Ireland, but on a national scale they’re still very manageable. The border counties are seeing the biggest hit, and are where hotels should be planning carefully.

A weaker pound means that Ireland and Europe is seen as a more expensive destination for UK and Northern Ireland travellers than previously. This will encourage them to stay within the Pound Zone rather than travelling within Europe.

To help you adapt a book direct strategy that involves growing other markets, take a close look at the tips above and decide which are most useful for your hotel.

Above all, hotels must stay flexible and ready to adapt as the snap election happens and the negotiations for Brexit grow more contentious. To maintain direct bookings in an uncertain market, careful monitoring and planning is key.

Talk to your Net Affinity Account Manager for more details or information on how to grow direct bookings.