Words By Taylor Smariga

The first half of 2016 has seen a sea change in the way hotels deal with direct bookings. Direct bookings are no longer an alternative to third party sites and more traditional booking methods (think: phones and walk-ins). Instead, they are becoming a major priority for huge hotel chains like Marriott International, Hilton Worldwide, Hyatt, Choice Hotels International, InterContinental and more.

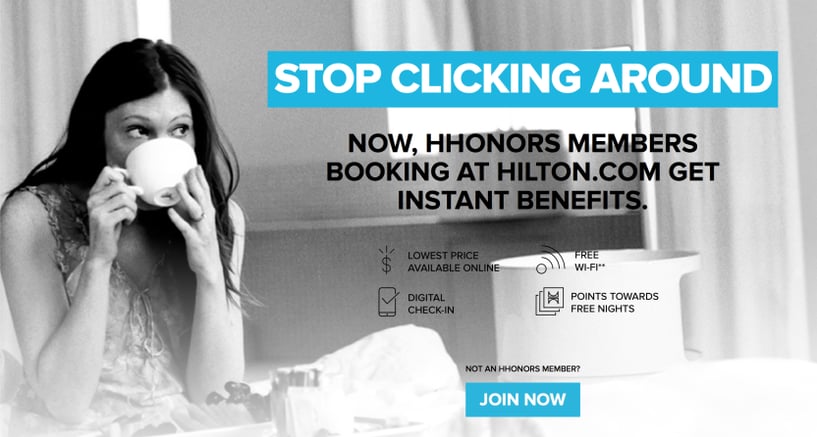

Marriott kicked things off last year with their “#itpaystodbookdirect” campaign, which was designed to highlight the benefits of booking directly on Marriott.com, including a best rate guarantee, perks and special deals. Hilton’s “Stop Clicking Around” campaign featured a similar message, complete with a catchy slogan and digital advertisements featuring The Rolling Stones’ “I Can’t Get No Satisfaction.”

These campaigns, along with Hyatt’s and others’, are catchy, widespread and influential – but why are they all happening now?

Why Has This Change Come Now?

For some time now, many hotels have been taking more notice of the volume of bookings from each online channel and how best to manage their presence on each channel. Hotels have been working to show a point of difference on the hotel’s own website to try to offer a compelling reason for the user to book direct. If a hotel can differentiate themselves successfully, they can out-perform their competitor set.

Today, the impact of the large chains launching public campaigns with Book Direct at the core has resonated on a widespread level. These campaigns put the idea that booking directly is best front and centre with consumers en masse instead of at a local level. It gives confidence to independent hotels that their efforts have not been in vain, and encourages them to increase their efforts to manage each channel. Independent hotels are inspired to sell the attributes of booking directly with the same gusto that OTAs have done for so long to convince shoppers that booking with them was the best option.

One reason this shift is occurring now is simply a domino effect. When Choice Hotels announced their book direct strategy, CEO Stephen Joyce said that Choice had been “very encouraged by what the other brand companies are doing… we are very much supportive of [a book direct] movement and we will be a major player as a part of it.”

Choice has seen some success from their approach, with an rise in membership for their loyalty programme, Choice Privileges, up 63% from a year ago.

Another factor working behind the scenes is the consolidation in the world of big hotel chains. The most recent example of this is Marriott’s purchase of Starwood, and we should be ready to see similar deals taking place. This consolidation gives big brands greater leverage with OTAs, meaning a strong Book Direct campaign is no longer the risk it once was.

OTAs Are Tightening Their Grip

The other, larger factor causing the new focus on direct bookings is that OTAs continue to consolidate as well. With Priceline’s purchases of Booking.com in 2005, Kayak in 2013, OpenTable in 2014 and others, along with Expedia’s recent streak of growth through acquisitions (Travelocity, Orbitz and HomeAway in 2015 alone), Priceline and Expedia have become bigger giants than ever.

As these OTAs consolidate, they control greater shares of the market and are correspondingly able to exert more control in their relationships with hotels. While big brands like those mentioned above can negotiate on something resembling a level playing field with OTAs, independents have significantly fewer bargaining chips to put on the table.

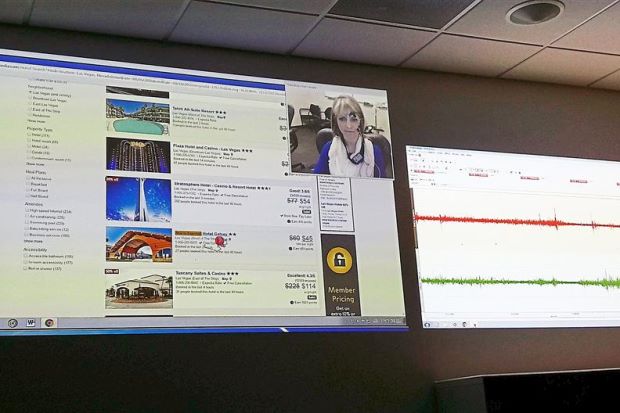

OTAs have the power to invest in buying major keywords (think: ‘travel to x,’ ‘hotels in y’), and also have the budget to put behind a cutting-edge user experience. Expedia’s CEO recently clarified that he considers Expedia to be first and foremost “a technology company,” and says that they spend over $800 million in R&D and technology every year. Some of that budget goes to the 1,750 A/B tests they ran last year, along with the use of two-way mirrors and monitoring of users’ emotions via tiny electrical impulses in their facial muscles – yes, really.

A glimpse inside Expedia’s user testing lab – source

Commissions paid to OTAs range, on average, between 15-25% per booking. While this is lower for major chains, where the figures fall more around 12-15%, they are still significant. The cost per acquisition of a direct booking is nearly always much lower for the hotelier. These rates average at about 4% for big brands, who have the advantage of in-house booking engines and a larger operation (which, as basic economies of scale tell us, means they pay less for each individual booking). For independent hotels, the rates are generally higher but still significantly less than OTA commission rates.

In today’s competitive landscape, every percentage point counts. Even for big brands like Choice, their CFO David White says the company is “not happy with the price points [OTAs] want.” If large multinationals are feeling the pinch, it’s a sure bet to say that independents are too.

Phocuswright’s 2015 report on the independent hotel market reveals that in Europe, OTAs and third party platforms represent 74% of online bookings for independent hotels, while chains receive 62% of their bookings through OTAs. With that level of reliance on OTAs and the growing control OTAs have in the relationship, it’s no wonder that hoteliers are seeking an alternative.

It’s important to note that no one wants or expects to cut OTAs out of the picture entirely, although the push for direct bookings is making them nervous. Instead, hoteliers are seeking a fairer relationship, with a more proportional amount of bookings going through third party sites and lower commission rates.

What Can Independents Do to Drive Direct Bookings?

So far, we’ve mainly addressed what branded properties are doing to combat OTAs and build their direct bookings. In most cases, what they’re doing is launching multi-million dollar ad campaigns, something that isn’t feasible for most independent hoteliers.

However, independent hoteliers can focus on their revenue management strategy and their book direct strategy. Paired, these will give your hotel an edge over your competitor set, let you take back control of your hotel’s profitability, and ultimately increase the lifetime value of the guest.

Here’s what independents can do to combat OTAs:

Develop a Smart Revenue Management Plan

- Start with pricing. Get this right before you tackle anything else!

- Truly flexible prices based on demand patterns

- Pricing per channel – one price does not fit all

- Beware of offer overload – do not have tariffs competing with each other

- After your prices are right, look to the world of non-pricing items – these include:

- Manage bookings per channel

- Usage of Stay Restrictions

- Implement Over-Booking Policy

- Review supplier contracts

- Set Up an Automated Revenue Management System – including:

- Date analysis

- Rate optimisation

- Rate shopper

- Forecasting and booking pace

One other note:

Read your OTA contracts. While some will have rate parity clauses, others will let you offer a lower price on your own site. Additionally, even those with rate parity clauses are usually restricted to publically available rates. This means that you can offer discounts to your newsletter subscribers and loyalty club members for booking direct, and you can also offer perks like free wifi to everyone who books directly on your brand.com website.

For a more detailed look at a smart revenue management strategy, here are 10 of the most important trends in revenue management today and a wealth of resources to dive into.

Keys to a Tailored Book Direct Strategy

When it comes down to it, a complete book direct strategy goes beyond smart revenue management, although controlling your pricing strategies is a key to success.

A book direct strategy touches on every aspect of your hotel’s marketing plan: your website, your marketing campaigns, the channels you’re on and how you manage those channels – even the images in your hotel gallery can strongly affect your direct bookings rate.

Here are a few of the most important areas to focus on:

- Customer paths to purchase are much more complicated than they were a year ago. That means potential guests can jump from browsing MetaSearch sites on their desktop, to checking out your brand.com website on their smartphone, to Googling local attractions on their lunch break.

Your hotel should strive to be at the forefront of as many of these touch points as possible to maximise your chances of snagging that booking when the pivotal moment comes. This could take the form of excellent content marketing, a strong ad campaign, or a robust presence on intermediary channels. It also makes a strong mobile website a must.

- MetaSearch sites are becoming an important channel for your hotel. Meta Search sites allow consumers to search for accommodation across several sites by letting users compare different listings side by side. While MetaSearch sites are almost exclusively owned by OTA brands, they allow you an opportunity to capture direct bookings that OTA sites don’t. If you aren’t present on MetaSearch sites, the only links potential guests on a MetaSearch site are going to see are links to OTA listings for your hotel.

If you’re actively promoting your website on these platforms, you’ll be able to generate a stream of direct bookings. MetaSearch sites allow independent hotels the opportunity to present themselves on a level playing field with the OTAs, and can offer direct bookings at a lower CPA than any OTA.

- Your PPC ads are key to driving potential guests to your site. Content is the new buzzword, but it isn’t a replacement for paid advertising – instead, it’s a complementary practice. When you’re creating your PPC ads, consider carefully which keywords you want to bid on. Often, the first ones that spring to your mind are the most popular, and OTAs will be setting higher bids than you and pushing your ad down the page.

How can you combat that? Bid on your brand name. A recent study from Bing Ads shows that, in the travel sector, the volume of clicks on your organic listing increases by 27% when brand ads are present. While some of those clicks will be cannibalized by your brand ad, without the brand ad competitors get 40% of clicks. With the brand ad present, competitors only get 12% of clicks.

- The design of your website will significantly affect conversions, for the better or for the worse. Your ads, presence on third party sites and the content you produce are all factors in how many visitors your website receives (and whether those visitors are the kind that are ready to book – but that’s another article). So, what determines whether the person who lands on your site will book a room? A big factor is the design.

Conversion-centred design simply means the rules of design that allow a potential guest to get from point A (arriving on your website) to point B (booking a room) as quickly as possible. The principles of good design remain the same, whether you have a large website to deal with or a simple landing page. Make sure to do your research!

Conclusion

These are only some of the building blocks of a solid book direct strategy. In the end, your book direct strategy should allow you to take some control back from the OTAs and put yourself closer to a level playing field. Direct bookings let you increase revenue in the short term, and increase the lifetime value of the guest in the long term.

What are your keys to a good book direct strategy? Let us know below!